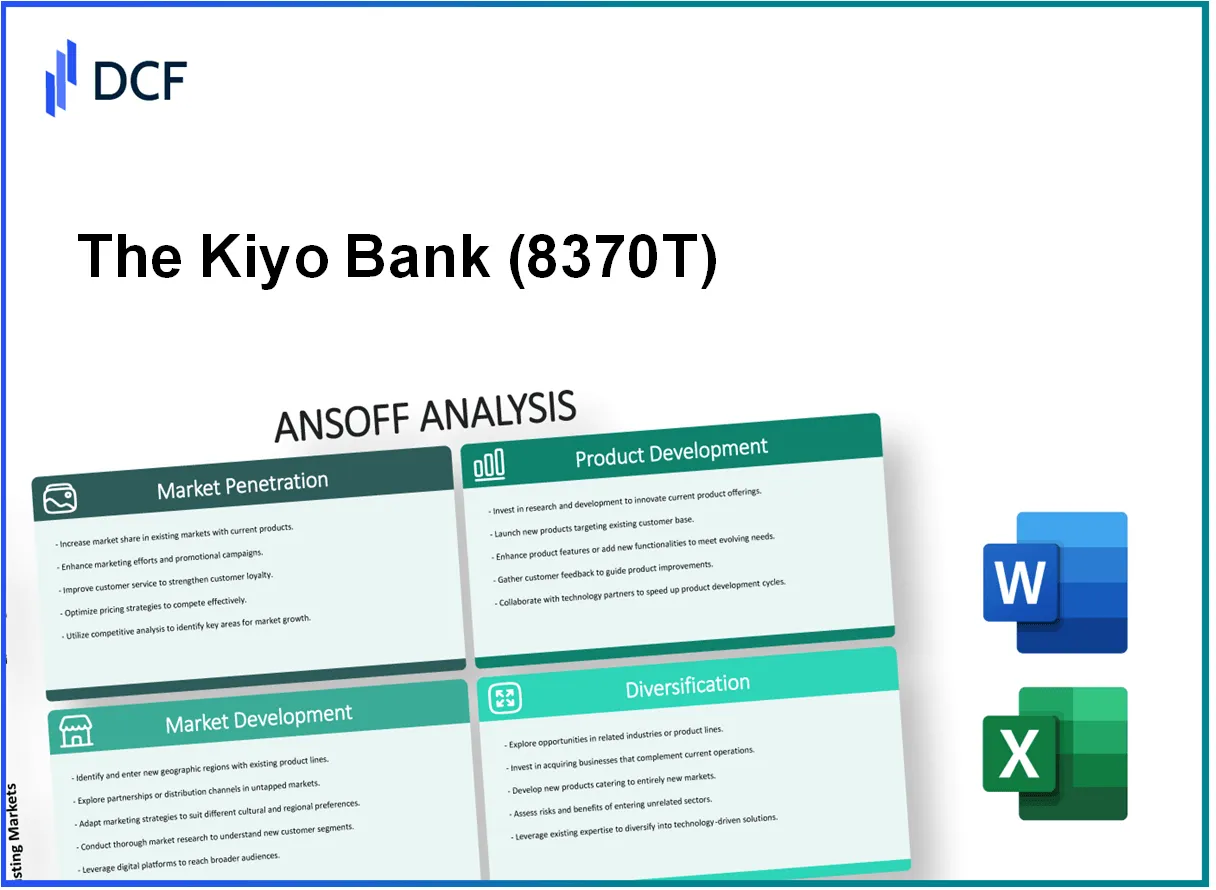

The Kiyo Bank, Ltd. stands at a pivotal point where strategic growth decisions can reshape its future in the competitive banking landscape. By leveraging the Ansoff Matrix—a powerful framework encompassing market penetration, market development, product development, and diversification—decision-makers can uncover new opportunities and fortify existing strengths. Curious to discover how these strategies can propel Kiyo Bank to new heights? Read on for a deep dive into each approach!

The Kiyo Bank, Ltd. - Ansoff Matrix: Market Penetration

Increase promotional efforts to boost usage of current banking services among existing customers

In the fiscal year 2022, The Kiyo Bank, Ltd. reported promotional expenditures of approximately ¥1.2 billion, a significant increase of 15% from the previous year. The bank's targeted marketing campaigns aimed to increase the adoption of their mobile banking app, which had a penetration rate of 30% among existing customers as of mid-2023. The bank's customer engagement strategy focused on personalized promotions, resulting in a 10% increase in the utilization of existing banking services.

Implement competitive pricing strategies to attract customers from rival banks

The Kiyo Bank has adopted competitive pricing for its savings accounts, offering interest rates up to 0.50%, which is currently higher than the average 0.25% offered by its main competitors in the regional banking sector. During 2022, the bank experienced a 5% growth in new customer accounts, attributed largely to its pricing strategy, which successfully attracted over 20,000 new customers from rival banks. Additionally, the bank's loan products maintained an average interest rate of 2.0%, closely matched to competitors, ensuring retention and new client acquisition.

Enhance customer service quality to improve customer retention rates

As part of its market penetration strategy, The Kiyo Bank invested ¥500 million in staff training and technology upgrades to enhance customer service quality in 2022. This investment contributed to a notable improvement in customer satisfaction scores, rising to 87% from 82% in the previous year. The bank reported a 25% decrease in customer churn rates, reflecting its successful efforts in retaining existing customers through improved service delivery.

Expand digital banking capabilities to increase convenience and usage

The Kiyo Bank has significantly expanded its digital infrastructure, with a reported ¥1.5 billion investment from 2021 to 2022 focused on digital banking enhancements. As of the end of 2022, the bank's online platform registered over 1.2 million active users, a growth of 40% year-over-year. In 2023, over 65% of all transactions conducted by the bank were digital, indicating a substantial shift towards online banking solutions. The latest mobile app update, launched in March 2023, received a rating of 4.8 stars on app stores, highlighting its usability and functionality.

Launch loyalty programs to reward frequent transactions and long-term customers

In 2023, The Kiyo Bank introduced a new loyalty program that allows customers to earn points for transactions, redeemable for various rewards. By the end of the third quarter of 2023, participation in the loyalty program surged to over 150,000 customers, resulting in a reported 20% increase in transaction frequency among participants. The program also contributed to a 15% increase in customer retention rates, with long-term customers showcasing a higher average balance growth of 8% compared to non-participants.

| Metric | 2022 Data | 2023 Data |

|---|---|---|

| Promotional Expenditure | ¥1.2 billion | ¥1.4 billion (projected) |

| Mobile Banking Penetration | 30% | 35% (projected) |

| Savings Account Interest Rate | 0.50% | 0.50% |

| New Customer Accounts Gained | 20,000 | 25,000 (projected) |

| Customer Satisfaction Score | 87% | 90% (projected) |

| Active Digital Users | 1.2 million | 1.5 million (projected) |

| Loyalty Program Participants | N/A | 150,000 |

The Kiyo Bank, Ltd. - Ansoff Matrix: Market Development

Enter new geographical regions with favorable banking regulations

The Kiyo Bank, Ltd. has been actively seeking opportunities to expand beyond its traditional markets. In fiscal year 2022, the bank reported a total asset base of approximately ¥6.5 trillion, with plans to enter markets in Southeast Asia where banking regulations have been identified as favorable for foreign banks. Regulatory changes in countries like Vietnam and Indonesia, which have shown growth rates exceeding 5%, present potential avenues for market development.

Develop targeted marketing campaigns for untapped customer segments, like young professionals

Research indicates that the young professional segment, aged 25 to 35, in Japan is increasingly underserved. The Kiyo Bank's targeted marketing strategy aims to reach this demographic with tailored financial products. For instance, the bank has allocated ¥500 million for digital marketing initiatives and partnerships with popular fintech applications to capture the attention of this audience, especially in urban centers.

Partner with local financial institutions to ease market entry

In pursuing market development, Kiyo Bank has initiated partnerships with local banks in target regions. In 2022, it partnered with Bank Negara Indonesia and exchanged insights to facilitate a smoother entry into the local market. This collaboration is expected to enhance customer trust and streamline compliance with local regulations, which can significantly reduce time-to-market.

Adapt existing banking products to meet the specific needs of new markets

The Kiyo Bank plans to adapt its existing suite of banking products, including loans and savings accounts, to cater to the specific needs of new markets. Market research indicates that the demand for microloans in emerging markets is on the rise, with a growth projection of 15% annually. As part of its market development strategy, the bank is considering launching a microfinance initiative that could contribute to its bottom line by enhancing accessibility for low-income customers.

Utilize digital platforms to reach potential customers in previously inaccessible areas

The Kiyo Bank has recognized the shift to digital banking as a critical factor in its market development strategy. The bank's investment in digital banking infrastructure increased by 25% in the last fiscal year. The aim is to leverage mobile banking applications to reach customers in remote regions, where traditional banking services are limited. Current data shows that 50% of Japanese consumers now prefer online banking services, a trend that Kiyo Bank is strategically capitalizing on.

| Market Development Strategy | Investment ($ Million) | Expected Growth Rate (%) | Target Demographic |

|---|---|---|---|

| Geographical Expansion | 50 | 5 | Southeast Asia |

| Targeted Marketing Campaigns | 500 | 8 | Young Professionals |

| Partnership with Local Institutions | 30 | N/A | Local Regulatory Compliance |

| Product Adaptation | 100 | 15 | Low-Income Customers |

| Digital Banking Infrastructure | 200 | 25 | Remote Areas |

The Kiyo Bank, Ltd. - Ansoff Matrix: Product Development

Introduce new saving account features tailored for millennials and Gen Z

The Kiyo Bank has initiated the development of savings accounts specifically designed for younger generations, such as millennials and Gen Z. A recent survey indicates that approximately 70% of millennials prioritize features like no monthly fees and mobile accessibility in their banking services. According to the Japan Banking Association, there has been a surge in demand for digital banking solutions among this demographic, leading to an estimated annual growth rate of 15% in digital banking transactions.

Develop innovative loan products with flexible repayment options

In response to the evolving financial landscape, Kiyo Bank is in the process of creating loan products that offer flexible repayment terms. The bank's research shows that over 60% of potential borrowers are interested in loans with customized repayment schedules. The average interest rate for personal loans in Japan currently stands at around 1.5%, while innovative product offerings could potentially extend the average loan tenure from 5 years to 7 years, enhancing customer appeal.

Offer tailored financial advisory services through digital platforms

Kiyo Bank is also focusing on delivering personalized financial advisory services via digital platforms. By leveraging data analytics, the bank aims to create customized financial plans for clients. Research conducted by Statista shows that the digital advisory market is projected to grow to $4.5 billion by 2025 in Japan. Kiyo Bank's goal is to capture 10% of this market by integrating advanced algorithms into their advisory services.

Implement new technology, such as AI, to enhance fraud detection and security features

The implementation of AI technology is another crucial aspect of Kiyo Bank’s product development strategy. The bank has reported an increase in online fraud attempts by 25% year-on-year. By incorporating AI-driven fraud detection systems, Kiyo Bank anticipates reducing fraudulent transactions by up to 30%. This investment will align with the global trend where financial institutions are expected to spend over $14 billion on fraud prevention technologies by 2024.

Create packages that bundle multiple services, offering added value to customers

Kiyo Bank is exploring the creation of service bundles that incorporate multiple banking products, providing enhanced value to customers. Research indicates that customers who utilize bundled services are 20% more likely to remain loyal to their bank. The bank aims to introduce packages that could save customers up to 7% on combined fees and attract a target of 100,000 new customers within the first year of launch.

| Service Type | Target Demographic | Projected Growth Rate | Estimated User Base (Year 1) |

|---|---|---|---|

| New Savings Accounts | Millennials and Gen Z | 15% | 50,000 |

| Loan Products | Personal Borrowers | 60% | 20,000 |

| Financial Advisory Services | General Public | 10% | 30,000 |

| Fraud Detection with AI | Online Users | 30% | 100,000 |

| Service Bundles | Current Customers | 20% | 25,000 |

The Kiyo Bank, Ltd. - Ansoff Matrix: Diversification

Launch a new subsidiary focused on fintech innovations

The Kiyo Bank, Ltd. has allocated approximately ¥2 billion for the establishment of a fintech innovation subsidiary. This initiative aims to develop cutting-edge financial technology solutions to enhance customer experiences. The market for fintech in Japan is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.4% from 2021 to 2026, reaching a valuation of ¥6.6 trillion by 2026.

Invest in developing an asset management arm to attract high-net-worth individuals

The bank intends to invest around ¥1.5 billion to establish a robust asset management division. This new arm is expected to manage assets worth ¥500 billion within the first three years, targeting high-net-worth individuals who seek tailored investment solutions. The asset management market in Japan is valued at approximately ¥80 trillion, indicating substantial potential for growth.

Explore non-banking financial services, such as insurance and investment products

Kiyo Bank is exploring partnerships with insurance providers to offer integrated financial services. The insurance sector in Japan is experiencing growth, with total premiums reaching ¥40 trillion in 2021. This diversification could enhance the bank's portfolio, potentially increasing overall revenue by 10% over the next five years.

Acquire or partner with startups that complement the bank’s service offerings

As part of its diversification strategy, Kiyo Bank has earmarked approximately ¥3 billion for strategic acquisitions. Recent partnerships include a collaboration with a local fintech startup focused on blockchain technology, valued at ¥500 million. The goal is to leverage these startups to strengthen service offerings and technological capabilities.

Develop a digital-only banking platform to cater to tech-savvy customers

The bank is set to launch a digital-only banking platform with an initial investment of ¥1 billion. The target demographic includes millennials and Gen Z, who represent over 40% of bank account holders in Japan. The platform is projected to attract 500,000 new customers within the first year, with projected revenues of ¥1.2 billion annually from digital services.

| Initiative | Investment | Projected Value/Return | Timeline |

|---|---|---|---|

| Fintech Subsidiary | ¥2 billion | ¥6.6 trillion market by 2026 | 3 years |

| Asset Management Arm | ¥1.5 billion | ¥500 billion assets managed | 3 years |

| Insurance Partnerships | Not disclosed | 10% revenue increase | 5 years |

| Acquisitions | ¥3 billion | Strengthened service offerings | 2 years |

| Digital-Only Platform | ¥1 billion | ¥1.2 billion annual revenue | 1 year |

The Kiyo Bank, Ltd. stands at a pivotal juncture, equipped with the Ansoff Matrix as a robust strategic framework to guide its growth initiatives. By focusing on market penetration, development, product innovation, and diversification, the bank can not only enhance its service offerings but also effectively tap into new customer segments and geographical regions, ensuring a well-rounded approach to sustainable growth in a competitive financial landscape.